How to finance a used car in 2024 step by step. Auto loans for a car with miles.

Financing a used car typically involves similar processes to financing a new car. If you’re looking for some advice on how to finance a car in 2024, here’s a bit of help. Here’s a general guide on how to finance a used car in 2024:

Used Car Loan Application 2024

Check Your Credit Score: Before applying for financing, it’s essential to know your credit score. Lenders use your credit score to determine the interest rate they’ll offer you. The higher your credit score, the better terms you’re likely to receive.

Research Lenders: Look for lenders who specialize in auto loans. You can approach banks, credit unions, online lenders, or even the dealership itself. Each lender may have different requirements and rates, so it’s worth shopping around to find the best deal.

Determine Your Budget: Calculate how much you can afford to spend on a car. Consider factors like your monthly income, expenses, and other financial obligations. Use online calculators to estimate monthly payments based on different loan terms and interest rates.

Preapproval: Getting preapproved for a loan can give you an advantage when negotiating with sellers. Preapproval involves submitting a loan application to a lender, who will then determine the loan amount and interest rate you qualify for based on your creditworthiness.

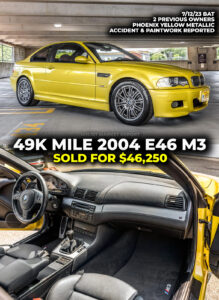

Shop for Cars: Once you have your financing preapproved, you can start shopping for a used car within your budget. Consider factors like the car’s age, mileage, condition, and resale value. You can search for used cars online, visit dealerships, or explore private sellers.

Negotiate Terms: When you find a car you like, negotiate the price and terms of the sale. Be prepared to walk away if the terms aren’t favorable. If you’re trading in a vehicle, negotiate its value separately from the purchase price of the used car.

Finalize the Loan: Once you’ve agreed on the price and terms, finalize the loan paperwork with the lender. Review the loan agreement carefully to understand the interest rate, loan term, monthly payments, and any additional fees.

Complete the Purchase: Sign the necessary paperwork to complete the purchase of the used car. This may include a bill of sale, title transfer, registration documents, and any other required paperwork based on your location.

Make Payments: Make timely payments on your auto loan according to the terms of the agreement. Late or missed payments can negatively impact your credit score and may result in penalties or repossession of the vehicle.

Consider Additional Services: Some lenders may offer optional services like extended warranties, GAP insurance, or vehicle protection plans. Evaluate these options carefully to determine if they’re worth the additional cost.

It’s essential to do thorough research and carefully consider your options before financing a used car. Make sure to read all contracts and agreements carefully and ask questions if anything is unclear. Additionally, consider consulting with a financial advisor if you need personalized guidance based on your financial situation.